Recent economic data paints a bleak picture of the economy in regards to the financial health of middle class Americans. This particular group is rapidly losing ground to another group sometimes derisively referred to as the “one-percenters,” (or as Marx called them the “bourgeois”) a group that averaged $5 million in wealth gains over just three years. The Global 1% increased their wealth also, growing their income from $100 trillion to $127 trillion in just three years

Let’s break that down into some an analogies we can all relate to:

Each Year Since the Recession, America’s Richest 1% Have Made More Than the Cost of All U.S. Social Programs

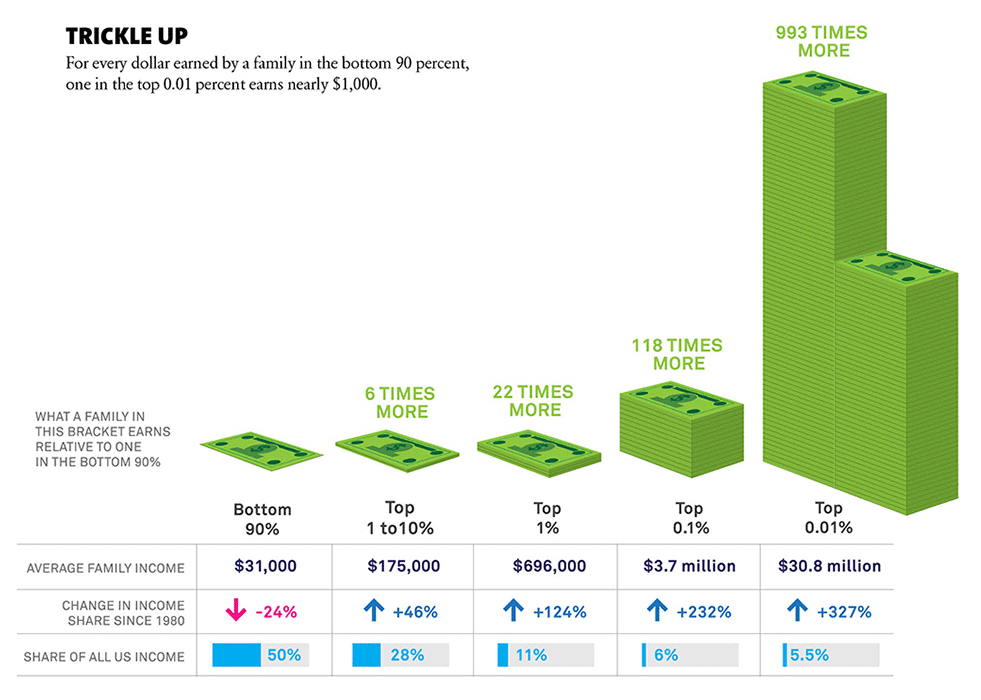

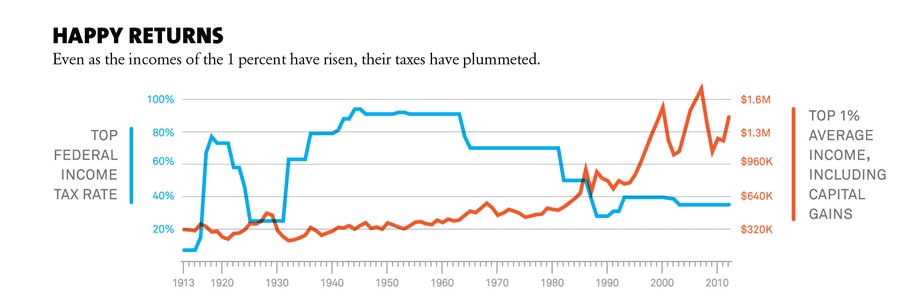

What you have here effectively is a reverse transfer from the poor to the rich. Even as political conservatives blame Social Security for being too costly and social welfare programs for being too generous, most of the 1% wealth club members are continuing to accumulate wealth at record speeds. The numbers are nearly unfathomable. Different estimates cite the American 1% as taking in anywhere from $2.3 trillion to $5.7 trillion per year.

Even the smaller estimate of $2.3 trillion per year is more than the budget for Social Security ($860 billion), Medicare ($524 billion), Medicaid ($304 billion), and the entire safety net ($286 billion for SNAP, WIC [Women, Infants, Children], Child Nutrition, Earned Income Tax Credit, Supplemental Security Income, Temporary Assistance for Needy Families, and Housing).

Even the Upper Middle Class Is Losing

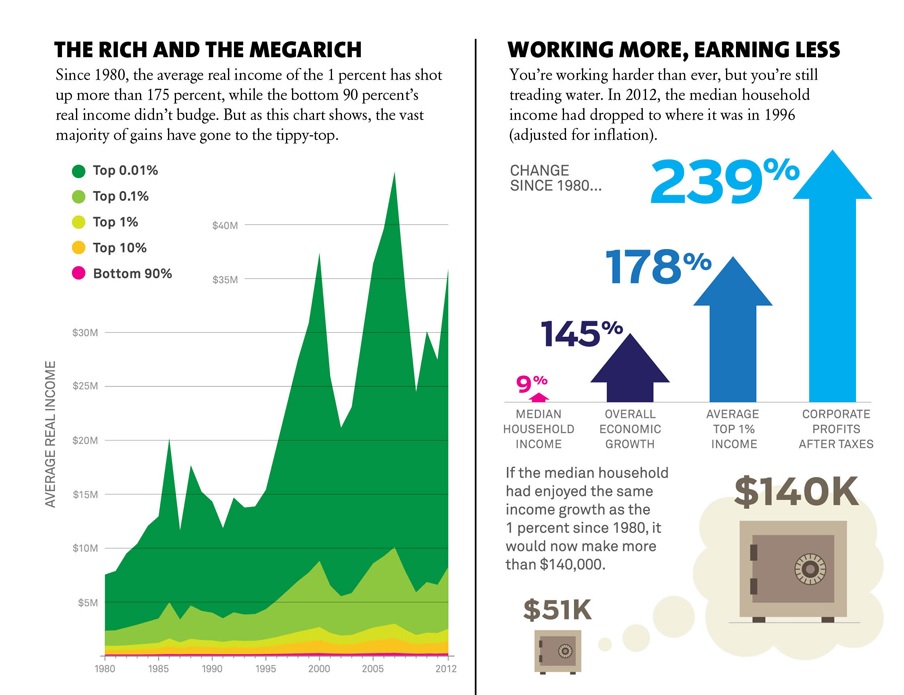

In just three years, from 2011 to 2014, the bottom half of Americans lost almost half of their share of the nation’s wealth, dropping from a 2.5% share to a 1.3% share.

Most of the top half lost ground, too. The 36 million upper middle class households just above the median (6th, 7th, and 8th deciles) dropped from a 13.4% share to an 11.9% share. Much of their portion went to the richest one percent.

This is big money. With total U.S. wealth of $84 trillion, the three-year change represents a transfer of wealth of over a trillion dollars from the bottom half of America to the richest 1%, and another trillion dollars from the upper middle class to the 1%.

Almost None of the New 1% Wealth Led To Innovation and Jobs

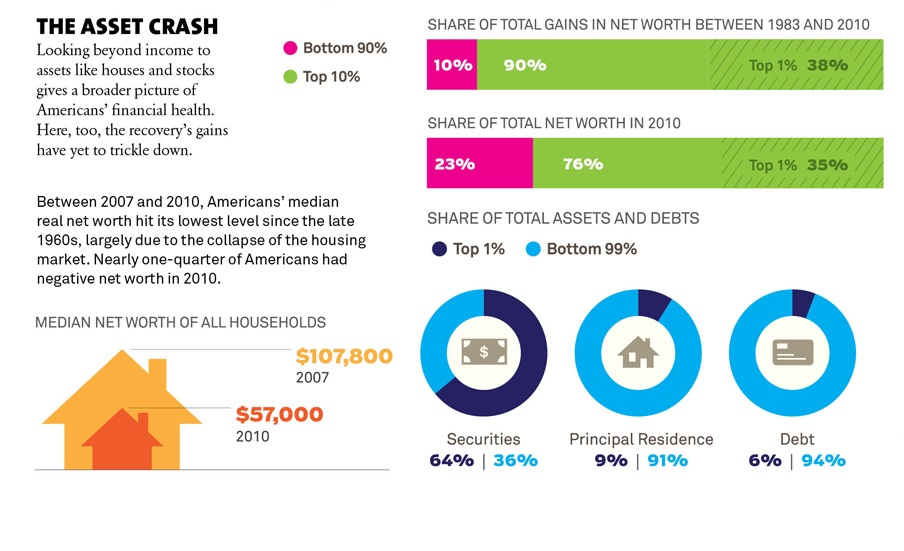

In 2005, for example, every $1 of financial wealth there was 66 cents of non-financial (home) wealth. Ten years later, for every $1 of financial wealth there was just 43 cents of non-financial (home) wealth. What happens to all this financial wealth?

Over 90% of the assets owned by millionaires are held in low-risk investments (bonds and cash), the stock market, and real estate. Business startup costs made up less than 1% of the investments of high net worth individuals in North America in 2011. A recent study found that less than 1 percent of all entrepreneurs came from very rich or very poor backgrounds. They come from the middle class.

On the corporate side, stock buybacks are employed to enrich executives rather than to invest in new technologies. In 1981, major corporations were spending less than 3 percent of their combined net income on buybacks, but in recent years they’ve been spending up to 95 percent of their profits on buybacks and dividends.

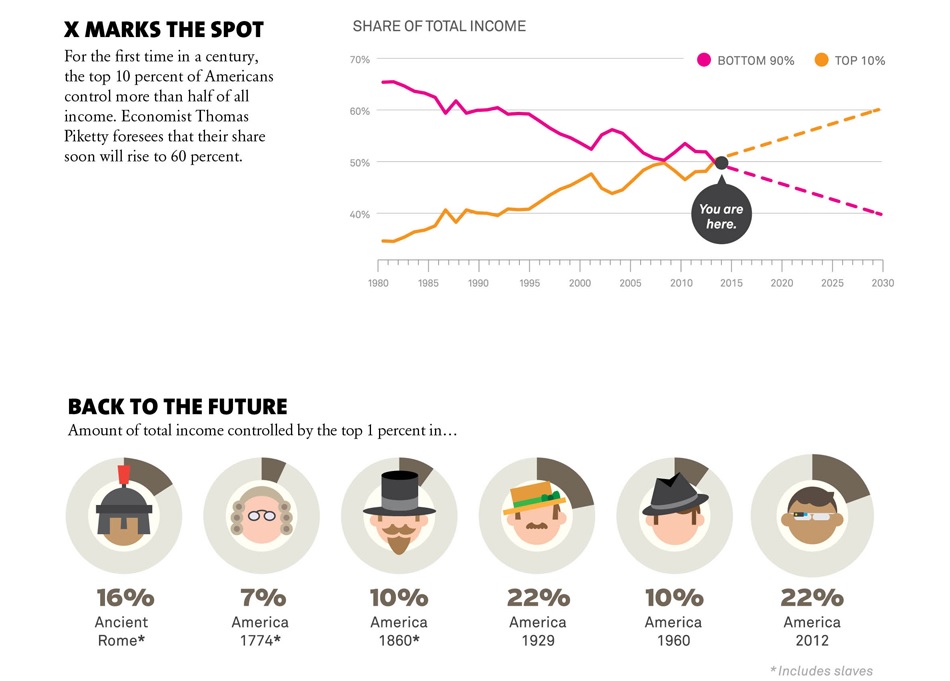

Just 47 Wealthy Americans Own More Than Half of the U.S. Population

Oxfam reported that just 85 people own as much as half the world. Here in the U.S., with nearly a third of the world’s wealth, just 47 individuals own more than all 160 million people (about 60 million households) below the median wealth level of about $53,000.

The Upper Middle Class of America Owns a Smaller Percentage of Wealth Than the Corresponding Groups in All Major Nations Except Russia and Indonesia.

The upper middle class in the U.S., defined as everyone in the top half below the richest 20%, owns 11.9 percent of the wealth. Indonesia at 10.5 percent and Russia at 7.5 percent are worse off, but in all other nations the corresponding upper middle classes own 12 to 27 percent of the wealth.

America’s bottom half compares even less favorably to the world: dead last, with just 1.3 percent of national wealth. Only Russia comes close to that dismal share, at 1.9 percent. The bottom half in all other nations own 2.6 to 10.2 percent of the wealth.

Ten Percent of the World’s Total Wealth Was Taken by the Global 1% in the Past Three Years

As in the U.S., the middle class is disappearing at the global level. An incredible one of every ten dollars of global wealth was transferred to the elite 1% in just three years. A level of inequality deemed unsustainable three years ago has gotten even worse.

For more on this, consider the following:

The Emperor’s New Clothes

The rich are getting richer, everyone else is struggling. Is that fair? Watch Russell Brand’s new documentary The Emperor’s New Clothes when it debuts in selected cinemas on April 21, 2015.

https://www.youtube.com/watch?v=mBCwM2UdV9c

Graphics shown here are published by Mother Jones magazine, which can be accessed at the following link:

More information appears in an article originally published by Alternet, which features data published by the Credit Suisse 2014 Global Wealth Databook (GWD). You can access it here: http://www.alternet.org/economy/stark-facts-global-greed-disease-challenging-climate-change

Discussion Questions

Despite overwhelming data and evidence that present day global economic policies, including domestic policies in the U.S., are by their very design transferring public sector wealth (tax dollars) into private hands, why do you think average Americans remain oblivious and even applaud this process? Why do they get upset about “welfare entitlements,” which pale in comparrison to the amount of their individual tax dollars that get used to underwrite the financial adventures (and misadventures) of wealthy people?

How do you think the different financial crises will impact you (i.e. global economic crisis, student loan debt, housing debt)?

Why is wealth and not just income inequality a problem?

It is absolutely incredible (or perhaps not) the fact that Americans don’t realize in what state their economy is specially when it concerns the obvious, The United States of America is the only country in the “first-developed world” that does not have stable social security, free education, accessible health care, etc…I believe that there’s still that hope that if one works hard enough, applies oneself strong enough, one one day will be rich, as rich as Donald Trump and as famous as the Kardashians. It seems as if there is such a nationalist delusional state, that everyone is guilty of the demise of the “Great America” but America itself and its colonial capitalist ways. The rise of the 1% and the fragile economic state in which American society is, is the product of its own invention.

Misconception, ignorance and our dogmatic ritual might be few of the reasons for our obliviousness. For instance, when we discussed about who invented technology in our class. Everybody including me agreed apple, Microsoft and other capital tech companies invented the technology we enjoy right now. We were stunned to find out it was the US government military intelligent who invented all this. We were totally misinformed by media which reminds me Marks quote“ The ruling idea of epoch are the ideas of ruling class”. The misinformation feed to us by the ruling class navigated us to produce a misconception “idea” that without these big tech companies we would still be in industrialization era deprived from all these amazing technologies. Similar technique is used to manipulate us to believe that America is under a threat of losing its power as a supreme country, if US military force does not keep other nation under control. We as a great American with high percentage of inadequate health benefits, child hunger and homelessness are convinced that the need to secure that power of our country is more important than solving education, child hunger, health benefits and other domestic issues. As a result, when our government spends 69 cents from each of our tax dollar on war we don’t budge. We just believe that people who holds the power of country has a best interest for us. They are just protecting our nation’s pride and us by provoking war where ever they think they need to. We the general people do not understand that our leaders are just the pawns from capitalists’ game. And the only thing they are interested in is to make more and more profits for their self.

When people think about the wealthy or the 1% they think about the people who have obtained household names throughout their career. The wealthy people are the people who have exceeded education standards and now have careers that will leave them in a comfortable position for the rest of their lives. The stigma belongs to the poor people who have no homes, no food, etc. They are believed to be the cause of the problem that we are in financial debt because of all the programs that are meant to assist these people in order for them to be back on their feet and so that they can move along with society. What people do not realize is that the difference between a poor person and a rich person is staggering. People who have once identified and still identify as middle class will always have the notion that they are not poor because they are not under the circumstances of what is considered a poor person lifestyle. The standards to be classified as a rich person has increased over the years, leaving the middle class to wither away and start to become classified as poor people. So long as the stereotype of what a poor person actually is still exists, people will classify themselves as middle class and rich and have no idea on how much more money the rich actually has.

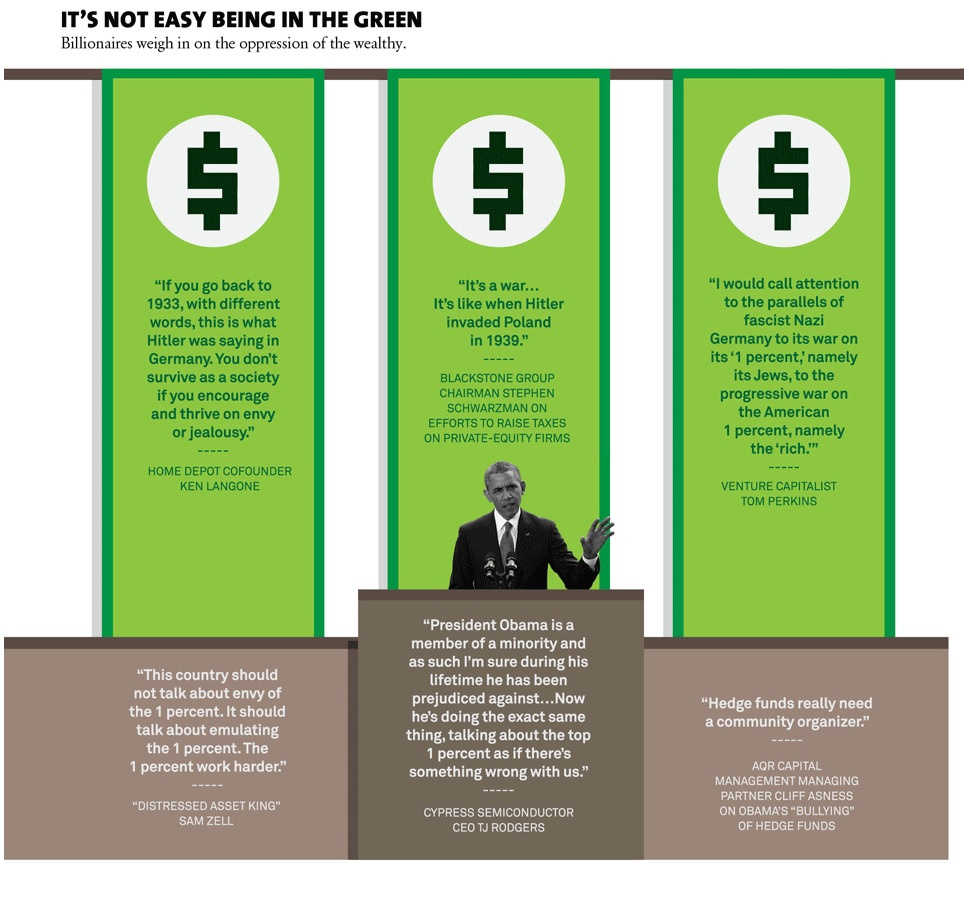

I think the average american is blind to this process because it is not the information the 1% wants out in the public. It is taboo for any politician or news program to speak of economic inequality. The minute a politician does he is demonized and cast as a socialist and his career is all but obliterated. Now of course news programs do not put this information out there because more often then not they are funded by the 1%, and there is no chance in hell that they would allow their rapid increase in wealth to slow down. I believe that another reason falls back on Marx’s idea of false consciousness, were many people in the middle class are being made to believe that all of their economic problems lie in the social programs that are being “given” to the poor. This is also the reason why many middle class americans get upset about social programs. Especially because all that you here in the news are the abusers of the system, and never about the countless people that it benefits and need the extremely little that they get from these programs to survive. Anecdotes are used to describe such abusers, a perfect example would be Reagan’s introduction of the “welfare queen” to the american public. This created the image in everyones mind that all people on programs such as welfare are lazy minorities.

The average American has been brainwashed about present day global economic policies because the wealthy control the media, and unfortunately, the average American just regurgitates and believes whatever they hear on television without even breaking down the merits and/or logic of what they are actually saying or believing.

You don’t have to write a book here, but in keeping with the spirit of the exercise, it would be great if you could demonstrate the same level of engagement as your classmates and share your thoughts beyond one sentence. This is a good start.

I think it’s quite evident why wealth is just as much of an issue as income inequality because just like people aren’t getting the compensation deserved, the top 1% are profiting from all of the wealth in the nation. This leaves everybody else either doing okay economically or struggling to make ends meet. Even the upper middle class has experienced a drop in their share of wealth, suggesting that the inequality is too extreme. When Oxfam reports that just 85 people own as much as half the world, there is a clear problem. I think that the different financial crises as already impacted me in the sense of student loan debt, which is the only debt that will not be forgiven. It definitely will influence me later on my life when I want to buy house and struggling with bank loans that have been slapped with outrageous interest rates when it took little for them to get. The insatiable greed corporations have needs to be dealt with or the market will fall because the only way for the economy to flourish is for regular Americans to have money to spend. The fact that we’re key to making everything work and for corporations to profit should empower people to stand up and demand change. Despite the overwhelming data and evidence that present day global policies, including domestic policies in the U.S., are by their very design transferring public sector wealth into private hands, average Americans remain oblivious and even applaud this process because they think they fall prey to their agenda and suffer from Marx’s false state of consciousness, thinking they can achieve this one day. People want so dearly to be a part of the wealthy and the wealthy do a good job at convincing people that they consider them a part of their elite, when in actuality they think the masses are scum. We’re mere cogs in the wheel for their wealth, but as long as they keep us interested and scapegoat a certain sector, they can control us. People don’t know what to do to fix the issues so they continue in hopes for something may change. If everyone did as Russell Brand’s documentary The Emperor’s New Clothes teaches, we, as the majority, can make a change for the betterment of everyone.

I think that the financial crises will in turn affect all of us. it may be to a different level for us but being we are all college students we all toke out loans of some sort. While my loans will total around 15,000 my roommate is taking 17000 a year. I just find it crazy that we all have these loans we are paying back and then on top of that we buy cars and homes and it just keeps on adding to the debt. Its very easy to see why some people cannot get out of debt with the constant build up. the worst part about college loans is they are immediate after you graduate. I feel this is unfair because in our time it is hard to get a job and have security. It should be few years before that start coming after you for loans after you have a steady and secure job.at the same time I understand why they come right away because they know you will make the minimum payments and not really pay much off so it keeps building up. I think for me personally although 15000 is a big number it is not nearly as bad as many others so i feel lucky in a way.

I think the financial crises will impact me hugely mainly because I am a college student. Its hard going to many schools without taking out loans. For private schools like rider every year they go up on the tuition. As soon as college is over you have to start paying back your loans a huge problem for most college students. Because of the financial crises its hard to find good jobs after college and even for people who aren’t in college its hard. You have to work mediocre jobs making it hard for you to pay your bills and pay your loans. Which is partly why there was an increase in boomerang children. The financial crises will affect me when I try to buy a home because of the debt I have accumulated while in college. It seems as though the odds are against us because you need to go to college in order to get a good job and in order to attend college you need loans. The catch is when you get that job most of your earnings is going to go back to paying off those loans. The one good thing about all this is loan forgiveness programs for state workers. Hopefully I can get a state job so loan forgiveness can help me with my college debt.

I believe that majority of people in the United States are oblivious to the wealth distribution for a few separate reasons. One would be the work oriented individualistic culture we have in the United States. People believe that you are successful because you work hard and save but in reality you have to manipulate the system to reach maximum profits for yourself. They applaud the rich out of envy and hope that they too can obtain the wealth through hard work which is an example of their own disillusionment. This main reason can also be attributed to the people’s negative beliefs of social welfare programs. Instead of identifying with the lower class who is struggling due to the system they instead blame them for the inequality. People believe that welfare recipients are lazy and that all of their tax money goes to them when in reality it is only a small portion of them that do. The two financial crises that will impact me are the student loans and housing issues. Higher education is becoming more and more expensive every year and student loan interest at the same rate. I believe I’ll be paying student loan debts close till I retire. With that being noted the housing market is also extremely dysfunctional making it harder for younger people to get homes at reasonable mortgages .

I think the different financial crises will severely impact me. The economy has been is slowly increasing but it’s at such a small percentage. Supply is still low while the demand continues to increase. The economy even affects one’s education regarding student loans. As tuitions increase and the availability of jobs are limited and it is hard for one to get a job after college. Especially one paying a decent salary in a person’s field of study. This is why people are struggling to pay off their loan debt and make a decent living. In effort to lessen the burden of student debt some people have started a trend of living at home after college just so they can use the money they would put towards a house or apartment towards their student loans. Unfortunately education has become a final priority. Student loans can deter many from attending college and universities. Many people cannot afford to pay for college whether it be in cash or loans due to financial struggles and poor credit. Education should be accessible to all. I personally was skeptical about attending college simply due to the fact that I didn’t want to have debt. However, I realized that without education one’s chances of receiving decent paying job is slim. Many people, including myself work while in school in order to lessen the burden of having loan debt upon graduation. Loans affect my education, without having them available, it will hinder my educational opportunities to complete my degree. All I can do is hope that I can be able to pay off my loans.

I think Americans remain oblivious to the process of transferring public sector wealth into the private hands for a few different reasons. First most Americans watch mainstream news stations that will never discuss this problem. The news stations do not discuss this because what they say is controlled by the rich people and this would not be in their benefit to do a story on how the middle and lower class is being ripped off by the upper class. Also I think even if they know about the average person may not feel empowered to make a change. Some people may even applaud this system because they may think that it is better and taking the duty off the state. For example the privatization of prisons is taking tax dollars and building prisons which are privately run for a profit. In this case the states sign contracts with the private prison systems to keep a certain amount of the prison full, which keeps the private company profiting. People will get upset over others who collect welfare because that’s what they are told to resent, and the thought of others receiving there hard earned money is tough. The media feeds into this idea as well, and the rich are able to fly under the radar while accumulating more and more wealth. The media can shape ideas of people so they think most people who collect welfare are sitting back not trying to do anything and living off of it. Although that’s not necessarily the case but there are some people who do end up living off the system. Large amounts of wealth accumulated overtime will give people more and more power. They will be able to control the media, and influence politicians in their favor.

In the U.S, research has shown that global economic policies are shifting tax dollars to private individuals, however despite this research finding the average American citizen is unaware or fails to believe these findings. The dominant ideology of society could be a major factor of this mind set. As Americans it is imbedded into our belief system that we must work hard, if we work hard enough we will succeed and that failure should be placed on individual’s actions not the society around us. These dominant ideologies of our indivualistic society is the main factor blinding the average American to ignore these findings, they are also the reasoning as to why people get upset about “welfare entitlements”. Many Americans simply believe that people who are on welfare do not work hard enough or do not want to work hard. They also believe that the rich are rich because they must work hard and if they work hard one day they will be able to achieve success when in reality research has suggested that social mobility in America is very low and people usually stay in the social class they were born into.

Wealth is the abundance of valuable resources or valuable material possessions. Social class is not identical to wealth, but the two concepts are related, leading to the combined concept of socioeconomic status. Wealth refers to just the value of everything a person or family owns. This includes tangible items such as jewelry, housing, cars, and other personal property. Financial assets such as stocks and bonds, which can be traded for cash, also subsidize wealth. Wealth is measured as net assets, minus how much debt one owes. Wealth is a restrictive agent for people of different classes because some hobbies can only be participated in by the affluent. This is a hierarchical structure that is constructed in society from lifestyle choices. People associate themselves with a certain class based on their wealth and interests, so it isn’t just a wealth and income problem.

I think that despite all the evidence and data pointing to the corruption in our system, “average Americans” aka white, middle class people are oblivious to and even applaud our current system because it is something they aspire to. No one wants to be poor and struggle; they all want to be rich, if not millionaires and lead plushy comfortable lives. They don’t want the wealthy to be taxed on their income because then they’ll have a higher tax bracket when they finally make more money. But they’re living in a deluded world. They are so far removed from the worlds of the lower class that they don’t realize that asking the poor to pay the same takes as the rich is absolutely insane. They don’t pay attention to the world of the lower class because it makes them feel uncomfortable, and no one wants to talk about things that make them uncomfortable. To be realistic, lower class people have to work infinitely harder and longer to make a fraction of what those at the top make. For example, the Russell Brand video said that the cleaners would have to work for 300 years to make what their bosses make in a year. That’s absolutely mental! We scold the poor for not picking themselves up by their bootstraps and working to improve their lives, but we don’t give them the opportunity to make enough money to do so. Not only that, but people applaud this because they don’t wan’t to pay taxes on money they “work so hard” to earn, but what they don’t realize is that those at the top often don’t work fractionally as hard as those at the bottom, but they appear to be self-made men/women, so that automatically makes it okay. They freak out about welfare because it makes lower class families seem to be comfortable where they are at, or give them an incentive not to work so they can continue to get welfare. People freak out about that but what they don’t understand is that by taking away welfare as soon as a family starts making income doesn’t allow them to establish any savings to build on. More often than not, families make more on welfare than when they start working, so can you really blame them for wanting to stay on? But unfortunately, people do blame them and criticize them for being victims of a broken system because those who “make the rules of the game” are often at the top and need to make themselves look good to stay there – regardless of how little they know (or care) about the lives of the lower classes. Middle class America is so focused on becoming part of the top 10% that they disregard the bottom classes, even though they’ll never be part of the upper class. They want the upper classes to like and accept them, so they like they things they like and don’t like the things they don’t. They’re oblivious to the fact that in the end, it doesn’t matter, and they’re only perpetuating a corrupt system.

Charles Darwin mentioned survival of the fittest which is similar to survival of the richest, NYC is becoming a state where if you are not in certain income bracket you

just cannot afford to live here. The cost of houses and food is very high. Majority of people have to turn to food pantry and shelters for help.

It’s shocking to see the new residential building arising on Park Avenue and at the same time realizing the project is a symbol of our economic tragedy. In the politics, the game concerning money is predetermined to favor the capital owned by the minority. So many alarming questions arise along the direction the majority of people are lead because the attitude of authority is getting bigger as we exercise our freedom to fight against inequality and the social conflict that is integrated in the struggle for survival of the majority!